FORM YOUR EMPIRE

Keep it legal with the State, structure it right for funding, prepare for success!

Who We Are

Head Start Biz Solutions is a company focused on covering other entrepreneurs in all facets.

Forming a legal tax entity with the State is one of the first steps to pursuing your endeavors. Let's rephrase, it's one of the first steps to keeping your paperwork in order and setting yourself up for legal tax deductions.

Entrepreneurs must juggle countless tasks and competing priorities well before they open shop, including the creation of a legal structure. Business formation is a necessary early step of starting a business, whether you’re registering a simple DBA, incorporating or forming a partnership. Head Start Biz Solutions will help you quickly get started with the process of creating a legal structure for your new business. From LLCs, S-Corps or Nonprofits, we’ve got you covered.

Business Services

File your business today and start building your vision.

DBA's & LLC's

Get your business registered with the state along with a bank account established. Experience tax benefits operating legally.

Partnerships

Whether you are big or small, it is vital who declares ownership and the percentages involved to each party.

S-Corporations & Nonprofits

Any LLC doing greater than $50k a year should consider converting to an S-Corp. Nonprofits deserve tax breaks too.

Shelf Corporations

Some concepts are amazing just quite challenging to accomplish without some business history.

LAUNCHING YOUR VISION

Pricing Packages

LLC & DBA

Traditional State Filing

$650

Limited Liability Protection

Pass-Through Taxation

Management Flexibility

Less Compliance and Recordkeeping

Flexible Profit Distribution

Credibility and Brand Perception

S-Corp & Nonprofit

Covers Conversion of LLC

$1,500

Pass-Through Taxation

Self-Employment Tax Savings

Enhanced Credibility

Limited Liability Protection

Easy Transfer of Ownership

Potential for Tax-Deductible Employee Benefits

Shelf Corporation

Reserve for starting bids.

$2,000

Instant Business History

Faster Access to Financing

Enhanced Bidding Opportunities

Expedited Business Operations

Improved Vendor Relationships

Privacy and Anonymity

Frequetly Asked Question

What type of business structure should I choose?

Business formation companies can guide you in choosing the right business structure—LLC, Corporation (C-Corp or S-Corp), Partnership, or Sole Proprietorship—based on your specific needs. They consider factors like liability protection, tax implications, management flexibility, and growth plans to help you make an informed decision.

What are my state’s requirements for filing a business?

Requirements vary by state, including fees, document submissions, and naming rules. Business formation companies provide information on state-specific requirements, such as filing Articles of Organization (for LLCs) or Articles of Incorporation (for Corporations), appointing a registered agent, and complying with any initial reporting or publication requirements.

How do I get an EIN, and why do I need one?

An EIN (Employer Identification Number) is a tax ID required for most businesses to open a bank account, hire employees, and file taxes. Formation companies can help you apply for an EIN with the IRS, which simplifies the process and ensures that you receive this important number for tax and financial purposes.

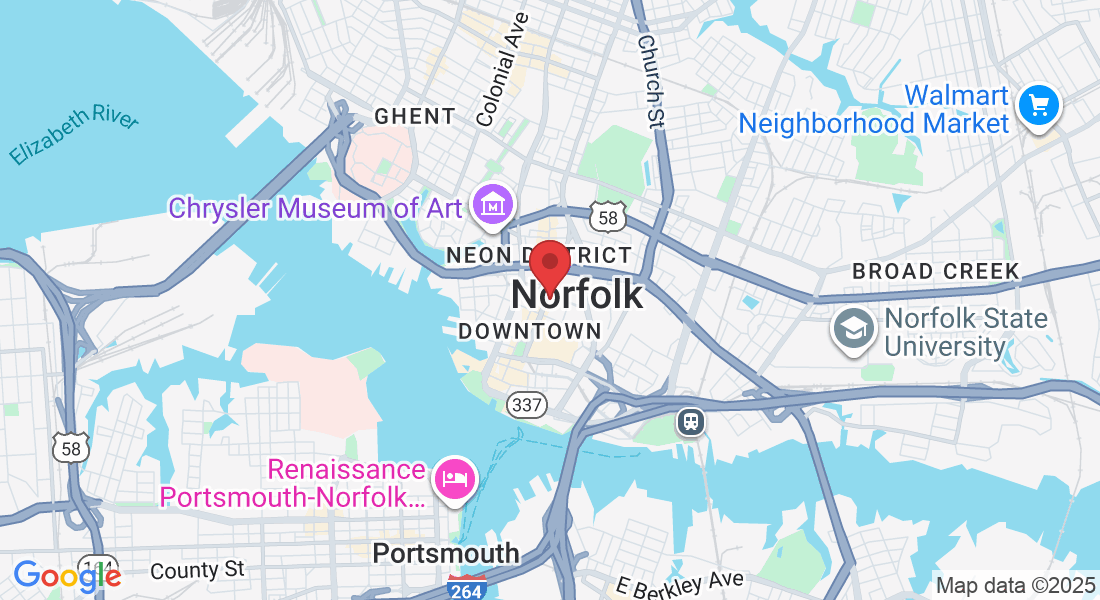

Get In Touch

Assistance Hours

Mon – Sat 10:00am – 6:00pm

Sunday – CLOSED

Phone Number:

(757) 993-4334